How much does it cost to

sell your home?

AGENT FEES

AUCTION FEES

MARKETING COSTS

HOME STAGING FEES

CONVEYANCING FEES

LENDER FEES

When considering selling your home, there are a number of costs you need to keep in mind.

From Marketing to Conveyancing, we’ve broken down each cost you may incur. Remember its important to also do your own research and get quotes when looking to sell.

Agent Fees

Listing your home with a real estate agent is always in your best interest (we may be biased!) as their wealth of knowledge of the area, the market and their buyer database will ensure your home sells fast, and for the best price in the current market.

A good agent will take care of all the heavy lifting involved in selling your home:

Researching and pricing your property

Setting up the marketing campaign

Meeting buyers at home opens

Following up those buyers

Negotiating the sale price

They will also draw up the contract for sale with all conditions and ensure it abides by the code of conduct.

They will also inform you of all disclosures that need to be made to potential buyers.

Agent Fees: Explained

Percentage Fee

Most agents in WA use a percentage fee. Ranging from around 1.8% – 3.5% depending on the agents level of experience and the area, this fee comes off the sale price of your home. Some agents may charge higher but include the costs of marketing, so be sure to check with them first.

Flat Rate

A flat rate means no matter what the agent sells the home for you will only pay that amount. at settlement they may need to pay out their fixed period (in the current market the interest rate you are going to is higher than your fixed so you won’t have to pay it out).

Sliding Scale

A sliding scale is where the agent fee is a percentage that gets smaller the higher they sell the property for.

The agent should provide you with fees for service schedule that outlines the fees.

Auction Fees

Not common to WA, but growing in popularity, auctions have the potential to achieve a premium

sale price for your property.

Auctions generate a competitive bidding environment, fuelling emotion amongst buyers and creating a sense of urgency that can reap strong results for the sellers.

They draw in genuine buyers who show up on the auction day prepared to buy - either with cash or pre-approved finance.

Auction provides three distinct opportunities to sell the property

Prior to Auction

At Auction

After/Post Auction

This gives the seller a good chance of achieving an early sale, while also ensuring there is plenty of opportunity for negotiations post-auction if a sale isn’t achieved under the hammer.

Buyers are also able to provide direct feedback to the seller and agent prior to auction day, giving a good indication going in of who the genuine buyers are and how much they are willing to pay.

Auctioneer costs can range from $400 to $1,000, depending on who your auctioneer is.

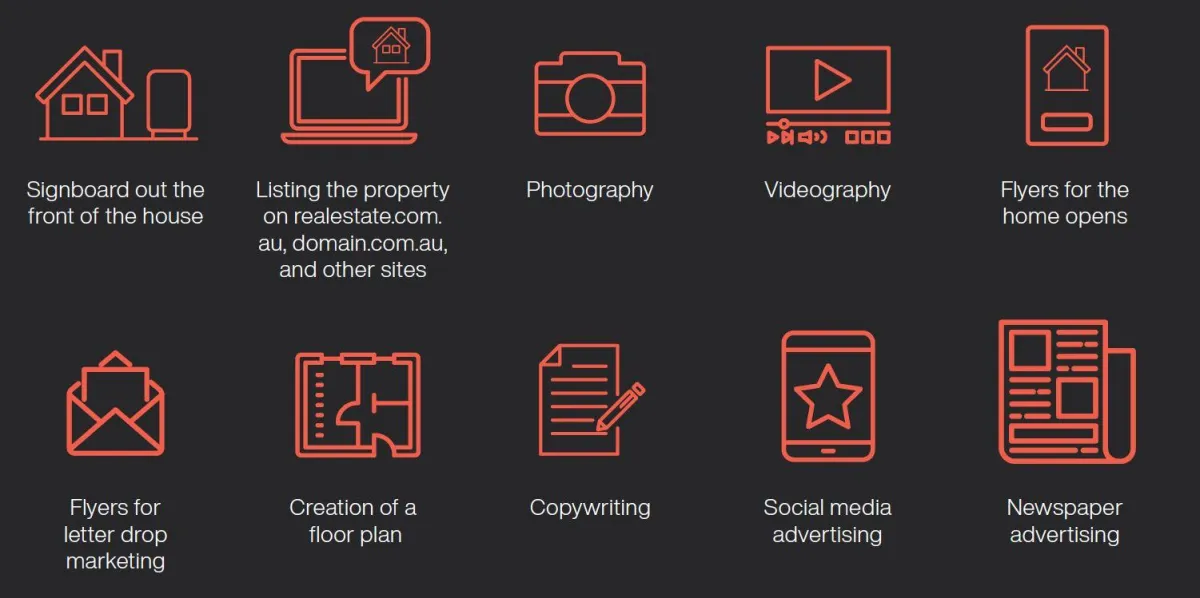

Marketing Costs

Some of the items that could be used to market your home:

Marketing your property in WA can range anywhere from around $1,000 to $10,000.

Each listing is unique and, depending on the budget, campaigns can be adjusted to suit. Some websites prices change depending on the level of subscription the company has, and also which suburb the property is in.

The more marketing and the better your property is presented, the more likely you are to achieve a higher price, so its definitely not something to skip.

Depending on which suburb you are in our marketing usually averages around $4,000.

Home Staging Fees

In order to maximize the sale price, many agents recommend employing professional styling and decluttering your home. When it comes to the cost of styling, vendors have the freedom to decide whether it will have a significant enough impact on the sale price to justify the styling process.

However, unless the property is slated for demolition, it is highly likely that presenting the home in its best possible state will yield better results.

When prospective buyers step into a house, they ask themselves, ‘Do I love it?’ and ‘Could I live here?’

Styling aims to enhance the property’s appeal, showcasing the space and ensuring it feels inviting.

The expense of styling can vary greatly, ranging from a modest amount under a hundred dollars to over $10,000 for fully furnishing and styling an empty property.

Sometimes you might just style a couple rooms to give the idea of how the space could be utilised.

A good agent will readily provide complimentary advice on how to declutter a home, as this can significantly contribute to its overall presentation.

Conveyancing Fees

Conveyancing is the process of transferring legal ownership of a property from one person to another and is required in every real estate purchase.

It can be done by licensed conveyancers and solicitors. Conveyancers, like those at Landmark Settlements Australia, will make sure all legal requirements are fulfilled, necessary documentation is completed and monitor the whole conveyancing process though to settlement.

They guide you through the process, and help you to manage obstacles or issues along the way. The fees associated can range from $700 to $2000 so keep this in mind when thinking about selling.

Lender Fees

If you have a mortgage on the current home you’re selling, you may need to pay your lender a discharge or early exit fee.

What are the big four banks’ home loan exit fees?

NAB: $350

Westpac: $350

CBA: $350

ANZ: $160

Your lender should have their own mortgage discharge forms to fill in, with the entire discharge process usually taking between 14 and 28 days. If you are using a mortgage broker, like those at Mortgage & Finance Solutions (Australia), they will ensure that you have your discharge paperwork completed at the start of the loan process to avoid delays at settlement.

Many lenders do not charge discharge fees, but for those who do, each lender charges their customers a different amount for this service, but it usually falls within the range of $150 and $400.

These fees are what you’ll have to pay to get a hold of your title deeds and they cover the administrative costs of discharging the loan.

What is your property worth?

Type your address here to find out

Disclaimer

This website uses cookies, so we can improve your experience on this site, analyse traffic and provide you with relevant advertising.

To find out more, please see our Cookies Policy in the Privacy Policy below. By continuing to use this site, you agree to our use of cookies.

Copyright ⓒ 2024 | Privacy Policy